A growing number of people aged in their 50s and 60s are allowing their bank accounts to be used to move money illegally.

Fraud experts say that among the increasing number being recruited as “money mules” – those who allow their bank details to be used to transfer criminals’ cash – are older account holders, as well as business owners who use company bank accounts.

Money mules are often not actually involved in crime, but allow their accounts be used as part of scams where cash is shifted quickly from one bank to another. In many cases these have been teenagers and students attracted by promises of gifts, or cash, in return.

But the cost of living crisis has, in part, fuelled the rise in older people taking part in the fraud, says Tristan Prince at Experian, the credit reference agency.

There has been, he says, a sharp rise in the last year in frauds where money mules have been used. New figures from the agency, which works to identify this activity, show that just over two out of every five instances of fraud on current accounts are related to money mules.

“Crucially, it’s not solely a problem for the young and vulnerable,” says Prince. “There has been a real shift in the profile of people being approached to become money mules. We’ve had instances where customers, who have been with banks for many years, and have had accounts with normal activity, and potentially driven by the cost of living or other challenges, have been approached to become a money mule and have decided to do so.

“Equally, we have seen business accounts being used. Some gangs will target businesses in financial difficulty, and pay them off, effectively to have access to their bank accounts.”

Knowingly transferring money on behalf of criminals is money laundering and can be punished with up to 14 years in prison. Money mules can also suffer from a poor credit rating and struggle to get a bank account.

The scale of cybercrime has ballooned in recent years and, with it, the demand for bank accounts to be used. “Criminals need somewhere to deposit and extract, legitimise and launder the proceeds,” says Prince.

Money mules can be targeted for recruitment by text messages or emails offering healthy returns for minimal work, through romance scams, cryptocurrency investment vehicles and many other methods.

Different messages are used to attract different types of mule – be they people who are short of money or looking for companionship, explains Prince.

Older mules are particularly attractive to gangs who run fraud scams, as banks have introduced systems to block criminal activity from young people, says Serpil Hall, head of fraud prevention at D4t4 Solutions, a technology firm that deals with fraud and scams.

“Criminals know that financial institutions put strong measures in place to monitor students’ and young people’s accounts,” she says.

“They changed tactics and moved on to existing customer accounts which have been with that institution for a number of years. Almost overnight the new target group moved to those in their 30s, 40s or even 50s.

“They choose various recruitment mechanisms to launder stolen funds – ‘get rich-quick schemes’, posting fake adverts on job websites and social media targeting those looking for work or in a difficult financial situation, such as coping with redundancy.

“Transaction fraud detection systems are great at spotting anomalies, but if you cast the net to business accounts, this makes it more complex – even for very sophisticated artificial intelligence (AI) – to spot anomalies.”

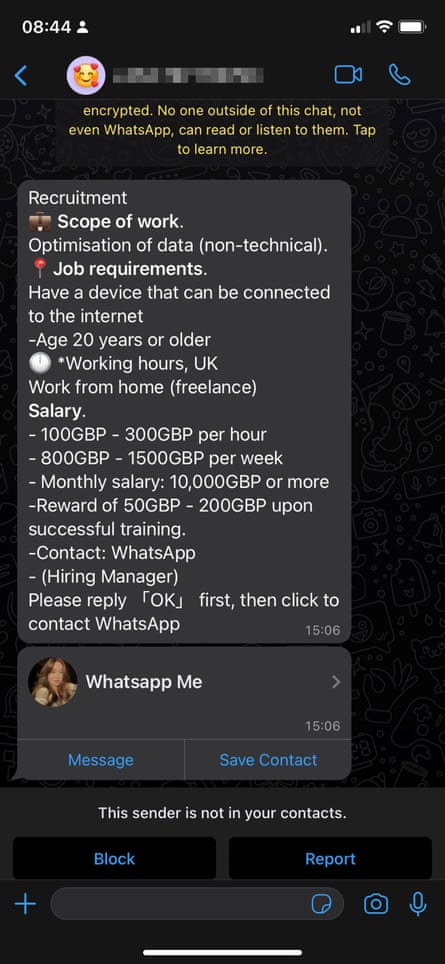

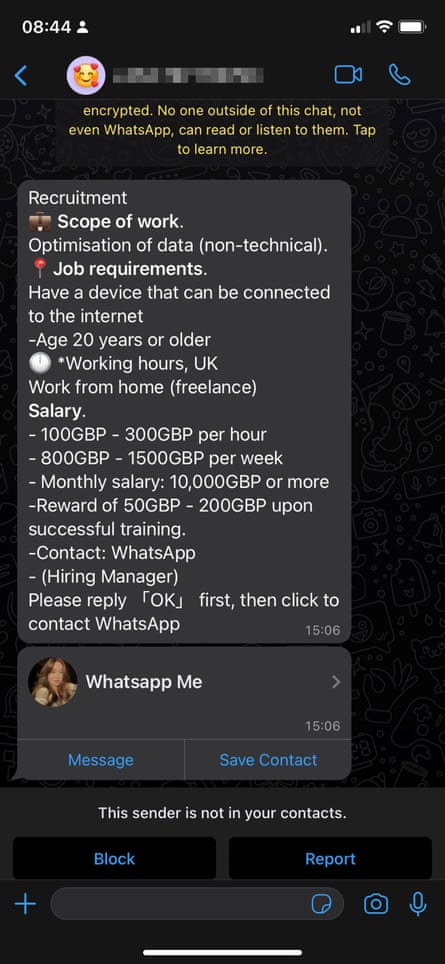

A typical text message sent by fraudsters to try to encourage someone to become a money mule. Photograph: WhatsApp

A typical text message sent by fraudsters to try to encourage someone to become a money mule. Photograph: WhatsApp

Cifas, the not-for-profit fraud prevention body, says that “mule herders” target older people, in part, because larger transactions from their accounts are less likely to arouse suspicions.

“We have also seen fraudsters tricking people into becoming unwitting mules by placing fake job adverts on recruitment websites and social media platforms,” says chief executive Mike Haley.

“Criminals request the bank account details of applicants on the premise that they are required to pay their wages, with amounts often ‘sent in error’ and requested to be transferred into a different account. Middle-aged people need to be increasingly vigilant, and understand that the consequences of being a money mule can be devastating and life-changing – both for them and their families.”

People in their 50s and 60s, who have allowed their accounts to be used can still be detected through “flags” that alert the banks, says Prince.

This could be a person who had never asked for a new account in 50 years, but suddenly applies for a challenger bank account in the middle of the night, which is then in receipt of thousands of pounds.

“Is £5,000 being received but then £4,000 is going straight back out? That difference is your commission payment for handling the money,” says Prince.

Typically, money held in a mule account is moved to between two and three others before being transferred to an international account, or a cryptocurrency wallet and then brought back into the UK financial system, according to Experian.

Often the mule accounts will be newly opened, but the holder will have older accounts that can still be used if the new one is shut down.