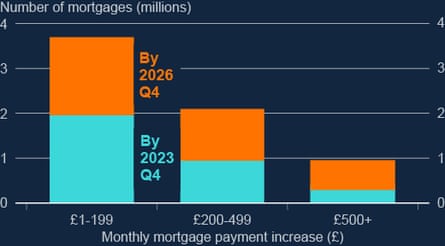

Almost 1 million UK homeowners will be forced to shell out at least £500 more a month to cover mortgage payments by the end of 2026, as borrowers suffer the “consequences” of rising interest rates, the Bank of England has warned.

Forecasts released on Wednesday showed that of the 4 million homeowners expected to roll on to new mortgage contracts over the next three years, the majority will be paying up to £220 more a month to cover the mortgage by the end of this year because of the difficulty of finding contracts with comparable rates.

The payments of more than 1 million borrowers are likely to rise by more than twice that amount by the end of 2026.

A chart forecasting the increase in mortgage payments. Photograph: Bank of England

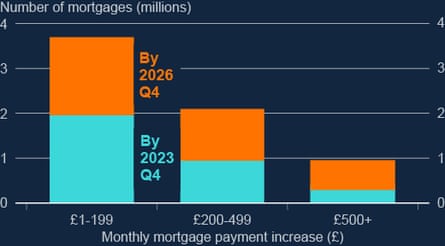

A chart forecasting the increase in mortgage payments. Photograph: Bank of England

Markets are increasingly betting that policymakers at the Bank raise interest rates beyond the current level of 5% to a peak of 6.25% in early 2024 in order to combat stubbornly high inflation.

The average two-year fixed mortgage rate rose to 6.7% on Wednesday – the highest level since the middle of the financial crisis in August 2008, according to data from Moneyfacts.

However, the Bank governor, Andrew Bailey, said higher payments were part of the wider economic trade-off of trying to tame price growth. “It is going to have an impact, clearly,” he said.

“That is part of the transmission of monetary policy, no question about that. And I’m going to come back to the point we’ve made a number of times … we are trying to balance having the transmission function of monetary policy with two things … one is the resilience of the banking system, and two, its ability to support customers and manage the consequences of this. But there still will be consequences of increased interest rates.”

Mortgage graphic

The Bank’s financial stability report also showed that the proportion of households under pressure because of rising mortgage payments had risen from 1.6% in November 2022 to about 2%. The figure is likely to reach 2.3% by the end of the year, affecting about 650,000 households.

However, policymakers were quick to point out that the figure was still below the 3.4% peak during the financial crisis in 2007, when 870,000 households were facing potential hardship as a result of mortgage payments. The Bank suggested that interest rates would have to be closer to 9% by the end of the year to match those levels.

“There are some big differences between now and 2007,” Jon Cunliffe, the Bank of England’s outgoing deputy governor for financial stability, said. “The amount of household debt that’s being carried is much lower now than it was the time of the financial crisis.” This trend, he said, was due in part to regulations that forced banks to rein in lending and carefully consider who could afford to repay mortgages before lending.

skip past newsletter promotion

Sign up to Business Today

Free daily newsletter

Get set for the working day – we’ll point you to all the business news and analysis you need every morning

Enter your email address Enter your email address Sign upPrivacy Notice: Newsletters may contain info about charities, online ads, and content funded by outside parties. For more information see our Privacy Policy. We use Google reCaptcha to protect our website and the Google Privacy Policy and Terms of Service apply.

after newsletter promotion

With the largest UK banks having passed the Bank’s annual stress tests, regulators said they were optimistic that lenders would continue offering forbearance options – including interest-only terms and extending the length of mortgages to reduce monthly payments – for those feeling the strain. The Bank said about 15% of homeowners who remortgaged in the first quarter had changed the terms of their home loans because of rising financial pressures.

“It is very helpful to have a banking system that can support its customers. I don’t think any of us want to go back to a world where the rate of repossessions of houses … [are similar to those seen during] the recession of the early 90s,” Bailey said.

“The effect that has on people and our families, we don’t want to get back to that world. We’re in a much better place for the banking system, where there’s support for customers.”

However, there has been a larger squeeze on smaller landlords with buy-to-let mortgages, who often struggle to receive any significant forbearance from banks since many are already on interest-only payment plans. Higher interest rates, coupled with higher taxes and regulatory changes, have put additional pressure on landlord profits. In some cases this has led to a sell-off to larger professional property managers, while others have passed on costs to tenants through higher rent.

“We have actually seen over the last year around a 5% increase in rents, and that is a product of the pressures that landlords are facing – partly as a result of those changing finance conditions … so we expect this situation to continue to evolve in that way,” the Bank of England’s deputy governor and head of its Prudential Regulation Authority, Sam Woods, said.