The European payments landscape has undergone a profound transformation over the past few years. According to an April 2019 report by the European Central Bank (ECB), electronic payments have grown significantly in Europe. Card payments have made an enormous contribution to the digitalisation of commerce and society as a whole.

In 2017, almost 70 billion payments were made. Cards were the most used electronic payment method, equalling 52% of all non-cash transactions in the EU; credit transfers accounted for 24% and direct debits for 19%. Meanwhile, new forms of payment are emerging across the EU through FinTechs, opening up more possibilities within the market.

According to a new report Cards in the evolving European payments landscape by Payments Europe, Europeans believe that card payments provide more added value than any other payment method. Nine in ten consumers (87%) across Europe feel comfortable paying by card as it helps ensure safe and secure transactions. 90% of retailers agree that the benefits brought by card payments outweigh any associated cost.

The study also shows that the use of cards has expanded over the past few years to be the preferred payment method for both consumers and merchants thanks to the significant benefits it offers compared to other payment methods. For consumers, benefits include convenience (49%), speed (35%), complimentary insurance (36%), retailer acceptance (40%) and cash back on purchases (35%).

Merchants overwhelmingly believe that card payments are more cost effective compared to cash payments, due to the labour and risk involved with cash. Almost two thirds of merchants (61%) argue that card payments are the most convenient for them. The main benefits compared to other payment methods include guaranteed payment (53%), increased sales (44%) and access to a broader customer base (38%).

“Our research shows that consumers and retailers have access to a broad spectrum of payments methods but that cards, whether physical or virtual, still rate as the highest among the different payment options. This demonstrates that Europe has a competitive payments market in which the card industry continues to deliver value to end-users,” explains Hendrik Frank, Board member of Payments Europe from Deutsche Kreditbank AG.

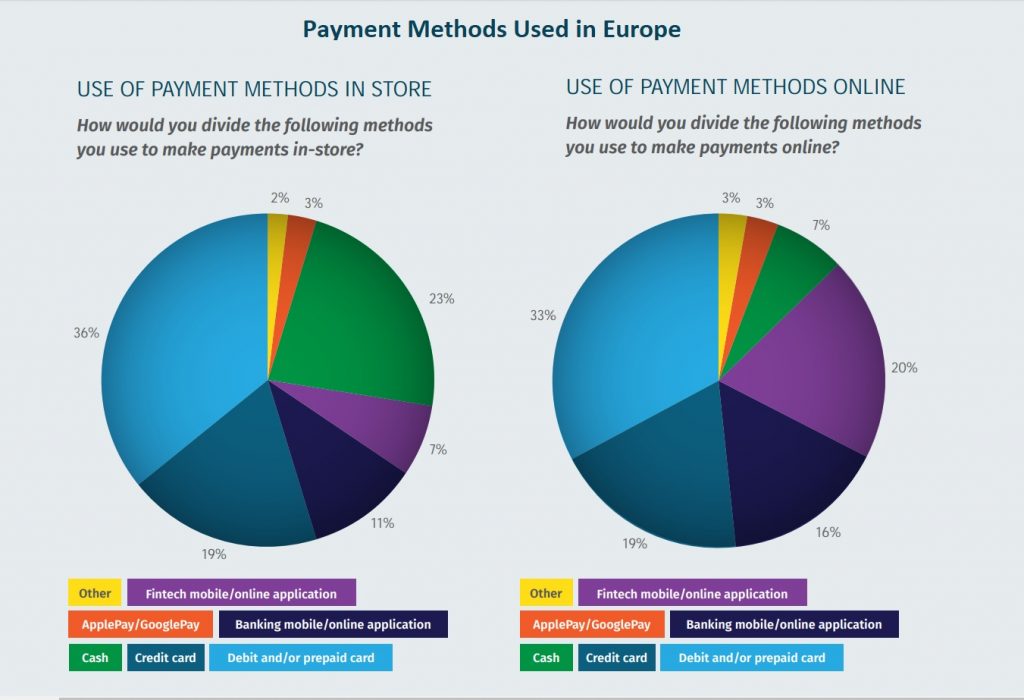

Each payment method has different features and functionalities, and consumers and retailers alike are increasingly choosing the method that is best for them or for a specific transaction, the research shows. This ultimately means that there are more choices available on the market now than there were in the past, when only cash and cards were competing.

“The payments industry is undergoing a period of unprecedented innovation, driven by shifts in consumer behaviour, new regulations and technologies. These factors are creating an increasingly open, dynamic and competitive environment, which can only be positive for European consumers and merchants,” adds Andrew Auden, board member of Payments Europe from Bank of America.